Our commitment

At James Fisher, we aim to ensure our resources are used in a sustainable manner, that we protect the life systems that support the planet’s natural resources, and that our workforce applies social and environmental awareness day-to-day.

People and Process Efficiency

The James Fisher Lean operating system was fully deployed during 2023. The immediate areas of focus are people, production and process efficiency. This is supported by the Head of Group Sustainability through the implementation of sustainability credentials sessions as part of the Green and Black Belt training curriculum.

Our Product Lines are at various stages with the implementation and use of Lean systems including; completion of Kaizen Funnels, value stream mapping, implementation of Gemba boards and the Obeya process.

2024 will see further cohorts of Six Sigma Green and Black Belt training with all Black Belt practitioners assigned a major target aligning with Group and Sustainability priorities.

Responsible Consumption

Our long-term aim is to deliver more with less than is required today. We seek to maximise the use of people resource, energy and materials through responsible consumption in processes and management of all business operations through our Lean operating system.

Through energy efficiency audits, consumption monitoring, and the application of three R's principles (Reduce, Repurpose and Recycle) we aim to reduce material waste and conserve natural resources throughout the business.

Our approach will include collaboration and the all-employee launch of our carbon reduction and energy efficiency initiatives site in 2024. The Environmental Working Group, in collaboration with the Health and Safety Forum, are developing a Group Waste Management standard which will outline the Group's expectations around responsible use and re-purposing of materials prior to responsible disposal.

Waste reduction is connected to many of the United Nations' SDGs and minimising it is an integral element of our Sustainability Strategy. To date, lack of comprehensive data has been an issue, mostly due to property lease agreement types where waste disposal arrangements are owned or shared with companies outside James Fisher. Our focus has remained on improving data collection methods, training and processes implementation throughout the Group. To support this, SLR, ESG consultants to James Fisher, are conducting an audit readiness review in preparation for a planned internal audit on our GHG inventory in 2024.

Energy Efficiency / Energy Savings Opportunity Scheme (ESOS)

During 2023 we have been working, with the support of third-party assessors, towards our ESOS phase 3 disclosure and plan to submit a notification of compliance in line with the ESOS deadline in June 2024. We plan to use the audit outcomes and the identification of carbon reduction and energy efficiency opportunities throughout the Group.

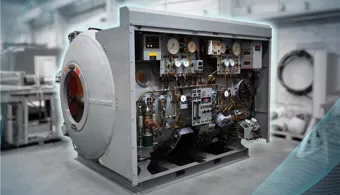

Assets Efficiency

Recogising there is a natural alignment between asset management and sustainability, our Group Project Management Office (PMO) is working to improve assets and resources utilisation. The team is supporting our Divisions in identifying asset efficiency opportunities throughout the standardising of frameworks and key processes.

A draft White Book Rate methodology was developed in 2023 defining roles, responsibilities and next steps for implementation. This includes rationalisation of Fixed Asset Registers, Asset Management Tracking and Professional Role definitions.

Improved recognition of operational asset costs has been established through a standardised approach for Project Status Reporting including Cost Tracking for Projects within PMO Governance Framework.

During 2024 we aim to establish a common Assets Management System and utilisation tracking across the Group.

Key priorities under the planet pillar of our sustainability strategy

You may also be interested in

JFD North America enhances US Navy Submarine Rescue capabilities with advanced Integrated Communication System

Read article

JFD successfully integrates and delivers advanced submarine rescue system for Republic of Korea Navy

Read article

Local jobs boost as JFD Australia's East Coast expansion continues

Read article

JFD secures £11m service contract with UK MoD ensuring long-term operational availability of their subsea capabilities

Read article

Rt Hon Ian Murray MP, Secretary of State for Scotland visits the new home of the NATO Submarine Rescue System

Read article

JFD Australia continues to expand its defence industry presence

Read article

Australia's submarine rescue system in safe hands as JFD Australia locks in contract extension

Read article

James Fisher strengthens APAC commitment with Japan entity

Read article

Annual Report 2024

Annual Report 2024