Why portfolio choices is important

James Fisher's activities in our core markets are inextricably linked to environmental considerations related to climate change and the energy transition.

This creates specific risks and opportunities that, when properly managed, open new markets and revenue streams.

Over the past 10+ years, we have strategically funded environmentally sustainable growth by actively reinvesting cash from our legacy position in oil and gas into both established and growing positions in the renewable energy and environmental remediation value chains.

PORTFOLIO CHOICES

| KPI | BASELINE(2021) | ACTUAL (2023) |

| % Revenue from renewables and remediation offerings | 17% | 16.4% |

Progress in 2023

Our focus during 2023 has been to align the organisation with our "One James Fisher" model. This will allow us to harness our collective strength in order to achieve a safe, sustainable transition to a low-carbon future.

Offshore wind is an important growth area for James Fisher and we will centre our expertise around installation, commissioning and Operations and Maintenance services.

Technology innovation remains key to meeting our own and customers' sustainability ambitions. We will be working closely with the newly appointed Chief Digital Officer and Chief Technology Officer through a shared drive to pioneer innovative and sustainable solutions and services and maintain our position as a trusted partner.

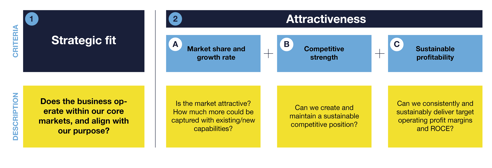

Active portfolio management

In line with our stated objectives and target, we developed and deployed a set of clear tests underpinned by well-established frameworks to assess all businesses within our portfolio.

In 2023 our revenue from renewables and remediation was 16.4 percent and we expect this to rise again in 2024.

Bringing termination and testing expertise to Ørsted and Eversource’s South Fork Wind project

James Fisher Renewables (JFR) is overseeing critical testing and termination services at State of New York’s first offshore wind farm, working with offshore wind leader Ørsted and their joint venture partner, Eversource.

During the summer the big bubble curtain solution was utilised during the installation phase. Using new technology developed in-house, the big bubble curtain created a barrier surrounding the piling of the wind turbine foundations, attenuating noise by up to 90 percent and protecting marine wildlife.

Multi-million-pound, long-term operations and Securing maintenance contract at Triton Knoll wind farm

A multi-million-pound contract was secured in 2023 at Triton Knoll offshore transmission (OFTO) project located in the UK, with the offshore platform 20 miles off the coast in the North Sea. We will provide complete end-to-end operations and maintenance (O&M) services to support informed decision-making for the OFTO, owned by funds managed by Equitix and TEPCO Power Grid UK.

We will operate, control and monitor critical assets through our 24/7 High Voltage Control Centre, and will implement a proactive approach to condition monitoring. This will ensure continued high voltage transmission availability and reduce unplanned outages; mitigating potentially significant financial consequences and impact on progress towards net zero emissions.

The contract will also see the team support Triton Knoll OFTO, ensuring the safety of the system is in line with high-voltage (HV) safety rules, which have been developed and tailored by the James Fisher team.

Key priorities under the planet pillar of our sustainability strategy

Along with portfolio choices, these are the key priorities under our planet pillar

You may also be interested in

James Fisher secures its first tidal energy project in Anglesey, UK

Read article

James Fisher and Tokyo Gas Engineering Solutions sign a Joint Collaboration Agreement to deliver offshore wind Operations and Maintenance services in Japan

Read article

Full Year Trading Update for Year Ended 31 December 2023

Read article

Appointment of Independent Non-Executive Director

Read articleJFD secures contract with TechnipFMC enhancing portable hyperbaric rescue capability and global support of diver safety

Read article

James Fisher's young talent receives Aberdeen’s 30 under 30 accolade

Read article

JFD showcases 42 years of subsea innovation to His Majesty King Charles III at Aberdeen’s Global Underwater Hub

Read article

Serviços Marítimos Continental recognised for operational excellence by Petrobras

Read article

Annual Report 2023

Annual Report 2023